All About Dubai Company Expert Services

Wiki Article

Dubai Company Expert Services Can Be Fun For Everyone

Table of ContentsUnknown Facts About Dubai Company Expert ServicesHow Dubai Company Expert Services can Save You Time, Stress, and Money.The Of Dubai Company Expert ServicesMore About Dubai Company Expert ServicesThe Facts About Dubai Company Expert Services Uncovered

Ownership for this sort of firm is separated based on stocks, which can be easily bought or marketed. A C-corp can raise resources by offering shares of supply, making this a typical company entity kind for big firms. S companies (S-corps) are similar to C-corps in that the proprietors have limited individual obligation; however, they stay clear of the problem of double taxation.A limited business is among one of the most popular legal structures for all kinds and also dimensions of services in the UK. This is due to the many expert and also economic benefits it offers, all of which far exceed those readily available to single investors or professionals resolving an umbrella firm.

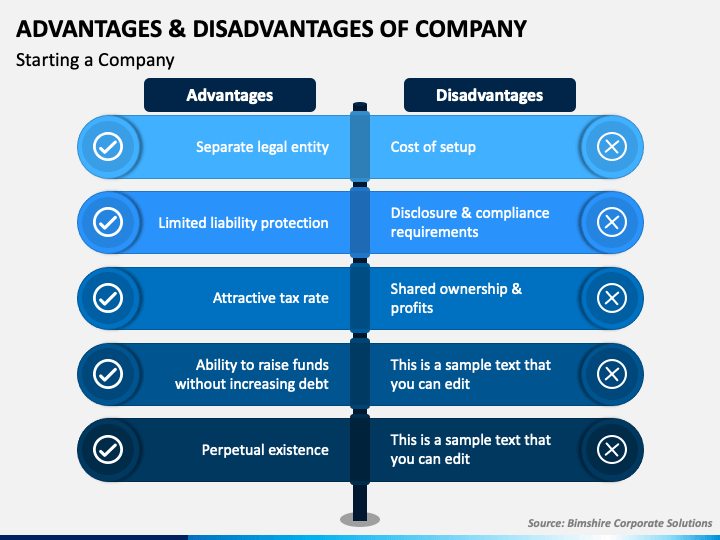

We will certainly additionally outline the possible disadvantages of business development when contrasted to the single trader structure. The principal reasons for trading as a limited company are limited obligation, tax effectiveness, as well as expert condition. Nevertheless, there are a variety of various other limited business benefits readily available. Below, we discuss every one in turn.

As a shareholder, you will certainly have no lawful responsibility to pay greater than the small worth of the shares you hold. If your business ends up being financially troubled and also is incapable to pay its creditors, you will just be needed to contribute the small value of your unpaid shares. Past that, your personal properties will certainly be shielded.

The Greatest Guide To Dubai Company Expert Services

They are directly responsible for any kind of as well as all company debts, losses, and obligations. As a single investor, there is no separation between you and your business.Whilst the activities, ownership structure, and internal monitoring of your business might coincide as when you were running as a single investor, firms are kept in much higher regard and also develop a far better impact. The distinction in understanding stems mostly from the truth that incorporated organizations are extra carefully kept an eye on.

Reinvesting excess money, As opposed to withdrawing all readily available earnings annually and paying more individual tax obligation in addition to your Firm Tax obligation liability, you can retain surplus income in the company to pay for future operational costs as well as growth. This makes even more feeling than taking out all earnings, paying higher prices of Earnings Tax, and also reinvesting your own funds when business needs added capital.

Furthermore, the firm will not have any kind of Corporation Tax obligation obligation on the salary due to the fact that salaries are a tax-deductible overhead (Dubai Company Expert Services). See likewise: You can take the rest of your revenue as rewards, which are paid from earnings after the reduction of Corporation Tax obligation. You will certainly take advantage of the annual 1,000 dividend allowance (2023/24 tax year), so you won't pay any kind of personal tax on the very first 1,000 of reward earnings.

Dubai Company Expert Services for Beginners

Returns tax rates are much lower than Earnings Tax obligation prices. Relying on your yearly earnings, you can conserve hundreds of extra pounds in individual tax each year by operating as a limited company instead of a single trader. Unlike the sole trader structure, a minimal firm is a lawful 'person' in its very own right, with an entirely different identity from its owners as well as directors.All business names need to be completely distinct, so no two companies can be established with the exact same name, or perhaps names that are very comparable to each website link other. The official name of your company can not be signed up as well as made use of by any kind of various other business. A single trader's company name does not appreciate this security.

There are some less good elements connected with restricted company development, as one would certainly anticipate from anything that Click Here offers so numerous advantages. Many of these perceived disadvantages fade in comparison to the tax benefits, improved specialist picture, as well as limited obligation security you will enjoy.

There is no legal distinction between the service and also the single investor. This suggests that you would certainly be wholly as well as personally in charge of all service financial obligations and also obligations. Your residence as well as other properties would certainly go to risk if you were not able to meet your monetary responsibilities or if lawful activity was taken versus the business.

Dubai Company Expert Services Can Be Fun For Everyone

The single trader framework is optimal for numerous small company proprietors, particularly consultants who have only a couple of clients and/or earn much less than around 30,000 a year. Nevertheless, there may come a time when it is financially or professionally useful to think about limited firm formation. If you reach that factor, your initial port of phone call should be an accountant who can suggest on the most effective program of activity.A limited company likewise provides numerous tax benefits; there are various advantages to having a respected professional photo and also condition; and also, you can establish a business for non-profit or philanthropic functions. The benefits must, nonetheless, be evaluated versus the additional money and time needed for the added management and audit requirements you will have to take care of.

This makes it the ideal framework for numerous consultants and also little organization owners who are simply beginning out, have very few clients, and/or create yearly profits below a particular amount. To select the ideal structure for your company, your decision must be based upon your very own individual choices, along with specialist, customized suggestions from an accountant or consultant that has a clear understanding of your organization purposes and also long-term plans.

The tax year for Self Evaluation runs from 6th April to 5th April the following year (Dubai Company Expert Services). look at here The existing tax obligation year began on Sixth April 2023 and also will certainly end on 5th April 2024. You can submit your tax obligation returns by message or online, and you can pay your Income Tax obligation and also National Insurance policy payments digitally.

Examine This Report about Dubai Company Expert Services

If you miss out on the final declaring target date by greater than 3 months, you will get a 100 charge. This penalty might be waived if you make an allure to HMRC - Dubai Company Expert Services. If you are late paying some or all of your tax, you may be billed a percentage of the exceptional equilibrium.Report this wiki page